As 2018 is almost over I think it’s time to review the portfolio and performance.

Overall result is -13%. Somewhat depends on calculations – I use broker day end values. so more or less… This can be compared to -9.7% FTSE all share (total return), far below my 30% target for the year. Many ideas havent worked this year so what has saved me is profit which was really from 2017 and rolled over the year end in the calculation – particularly Tejoori.

Long term performance has been strong – still 7X up over the last 10 years – long term chart below:

I like the above chart, puts bad years in context.

In order of portfolio weight / impact – a brief review of the year’s holdings and performance.

Tejoori – paid out – but I am not likely to get any more wins of this size – it was a high portfolio weight 19%+ upon relization. Issues with liquidity mean I am increasingly nervous about putting this much in this sort of stock in future.

Crypto holdings – KR1 / direct Crypto. I was lucky enough to see the writing on the wall with these and exited in Febuary. My Tether (crypto) short was a drag on performance due to 20% financing fee on a leveraged position. I have exited this but am looking to reapply my short once I can find a more cost-effective way of doing it.

Origo Partners – the year’s biggest disaster. I was seriously hurt by lack of liquidity and the underlying company being filled with frauds. The loss was 4% of my portfolio. Looking at the 0.25p price now my sell at 0.8 looks inspired, similarly sales of the prefs at 0.2 where as now it is 0.14. Particularly disappointed in this as I advised family in (who I let out before me). Its made me reconsider my concentration – as I get bigger I think I need to be much more aware of liquidity.

Rasmala – not as big a weight but a disapointing loss following delisting – I didnt trust the tender. I suspect my decision on this cost me money but may still have, strangely, been the right thing to do.

Produce Investments – exited this, was taken out not long after.

Walker Cripps – so cheap. Not much happening, holding.

PV Crystallox – still waiting for cash, am up a touch. Not a good investment – took too long. Will likely give it till end Jan before I think about getting out of this.

Dragon Ukranian Property – still waiting, have eased up position a touch.

4D Pharma, massively down – c59%. Not concerned. Think this is undervalued and will rise – reluctant to put more money in though, might put a touch in.

Infrastructure India, sold some on price spike / twitter pump and dump. Position now is very small, and practically free. Nervous on delays regarding financing, to me its taking too long. Now a very small position.

Fondul Proprietea – core holding, done OK over the year, still pays a divi, Romanian blue chip at c37% discount to NAV. Happy to wait as NAV has been rising. May be hit in a recession but I think I want to be buy and hold on this.

Fox Minerals – am down a bit on this – c33%. Happy to wait as I think good things are happening. Not sure how a big worldwide recession will affect it but massive resource backing.

Alternative liquidity fund (ALF). Still liquidating quietly / slowly. Discount to NAV has narrowed – but I am not entirely sure there isn’t hidden value here. The vision funds are marked in the NAV at a discount due to criteria such as being based in an EM country/ SEC litigation (see here (P2)). BUT the assets held (as far as I am aware) depend mostly on litigation / government action. I don’t think a discount makes sense here – this will either work or not. I will review this in the new year. I have had more than my initial investment back on this.

Tau Capital – almost 100% loss based on market price – but a good chance of an RTO / cash back if it liquidates.

Dolphin Capital – not much happening, content to wait. Concerned this will be hit if there is a big recession.

Shanta Gold – actually doing very well, unbelievably up about 20% since I posted (Shanta Claus rally), on no news. Very small weight though. Should have put more in – idea was to buy more gold miners. Issue is I am struggling to find things that are as good as this!

Riverfort Global – small position I havent posted on. They are, in effect an investment trust that is the equivalent of a payday lender to natural resource cos. Good track record of 20% PA returns, trading at a c20% discount to NAV. Management buying in, decent institutional backing, they get warrants giving potential long run upside if natural resources take off…

Looking at the above not much seems to have worked this year – so how can I be just 13% down? I am surprised myself. The fact is, as I have been heavily in cash / gold / silver. As a UK based investor not too happy about holding GBP right now.

Things that havent worked have been very low weights – <5% often, things that have worked are much bigger. You can see this in the complete weights table below (I should post this more often as it is really important to get weights right when investing.)

Right now I am 75% cash/metals/PVCS – (which is almost cash). I also have borrowed money, sitting doing nothing, ready for a buying opportunity.

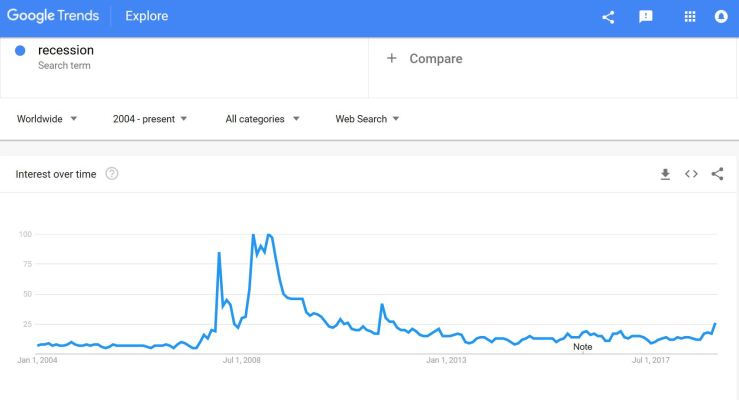

Very difficult to know what to do here. Much indication a recession is coming. One of my favourite tools to track the zeitgeist is Google trends….

Also see this particularly charming smart money flow chart.

Having said this there appear to be lots of bargains out there. My watchlist is increasingly packed with stuff I want to buy. I dont want to miss out but don’t want to be catching falling knives either.

I am in two minds here what to do. Wait until I see what I believe is capitulation, or buy now but hedge with puts / other shorts, or some combination of the above. I am inclined to think that things can and probably will get much cheaper from here so won’t be rushing in. Particularly as a (mostly) UK based investor with Brexit to think about.

There are those who say you shouldn’t market time like this. I disagree, even if you are wrong in your market timing 60% of the time – as long as you make more than you lose you still come out ahead. What you should avoid doing is being a forced seller on lows. I also avoid buying stocks making new highs – usually – though lots of good investors can/have made money doing this.

Some of this is not entirely down to judgement – I was busy studying for CFA Level 2 first six months of the year. I wouldn’t want to say whether this hurt or helped performance. I’ve also been looking to change job – another distraction, again difficult to say the performance impact. I got (voluntary) redundancy from my current job so shortly will have even more cash to invest. Am actually thinking of investing full time but I think I don’t have quite a big enough pot. Having said that, if the market slumps as much as I think it might – its a once in a lifetime opportunity which I won’t miss.

Looking forward to 2019. Lots to do but I need to be very careful. Reluctant to put a number on how much I aim to make. Given conditions, I think at some point next year I should be willing to lose a max of say 20-40% on a portfolio level but with the goal of gaining 50-100%/200%++. I am never going to exactly time the bottom and shouldn’t try. If I am within 20-30% that is good enough. Also I wouldnt want to assume next year would necessarily be the bottom. I could also do with a bit of a confidence boost given the bad run this year. Unlike most investors who need to take fewer, more focussed actions, I need to make more, possibly smaller, bets.

Posts, will be here and on Twitter (@DeepvalueInv).

Comments, as ever, are appreciated.

how much money are you investing in this portfolio as a whole that you were able to put that much of a position size in Tejoori? I barely could get 100k in it.

Hi Marvin,

I don’t disclose how much money I have invested. To some of the very wealthy who I know read my blog it undermines my credibility, despite decent returns over a reasonable length of time. I am not particularly wealthy all things considered, I started with nothing and still have most of it left!

For others my ‘wealth’ could make me a target, all depends how you look at things, so I avoid the issue whereever possible.

I could get over 100k shares in TJI. Key was buying when interest in the stock was low / the case was less clear, liquidity is never there when you really need it. I probably don’t help by buying all I want before posting.

Rasmala tender was undersubscribed.

http://rasmala.com/2019/02/results-of-the-tender-offer/

That surprises me and it cost me quite a lot – not sure what else I could do with the information I had at the time.