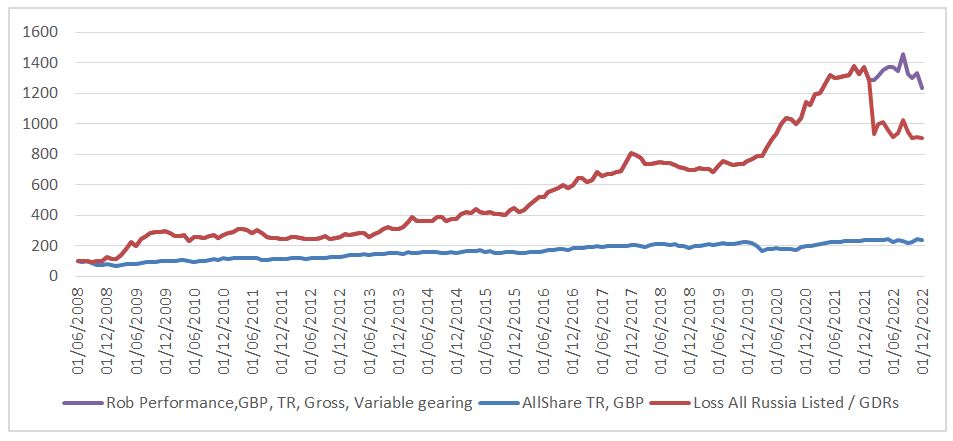

So time for my usual review of the year. As ever, I’m not writing this exactly at the end of the year so figures may be a bit fuzzy, in general they are pretty accurate.

As expected, it hasn’t been a good one. If you assume all my MOEX stocks are worth 0 I am down 34%, if you take the MOEX stocks at their current value I am down c10%. This is very rough, I also have various GDR’s and a reasonable weight in JEMA – formerly JP Morgan Russian. So if all Russian stocks are a 0 you can probably knock another 3-5% off.

My traditional charts / table are below – including figures *roughly* assuming Russian holdings are worth 0. It’s a little more complex than this as there are pretty substantial dividends in a blocked account in Russia and quite a few GDR’s valued at nominal values, I could easily be up 10-20% if you assume the world goes back to ‘normal’ and my assets are not seized, although at present this seems a distant prospect.

We will see what happens with the Russian holdings but I am not optimistic. If the Ukraine war continues along its current path Russia will lose to superior Western technology / Russian depleting their stocks. The Russian view seems to be to have a long drawn out war – winning by attrition / weight of numbers / economics. The EU is still burning stored Russian gas, with limited capacity for resupply over the next two years, 2023/2024 may be very difficult. I don’t think this will change the EU’s position but it might. Another likely way this ends is nuclear / chemical weapons as it’s the only way Russia can neutralise the Ukrainian / Western technological advantage. A coup / Putin being removed is another possibility, as is Chinese resupply /upgrade of Russian technology (though far, far less likely). I think the longer this continues the more likely Russian reserves are seized to pay for reconstruction and western holdings are seized in retaliation. I still hold JEMA (JPMorgan Emerging Europe, Middle East & Africa Securities) (formerly known as JP Morgan Russian) as I get a 5x return if we go back to ‘normal’, 50% loss if assets are seized. If you are in the US and can’t buy JEMA a similar, (but much, much worse) alternative is CEE (Central Europe and Russia Fund). I might write about it if JP Morgan do something dodgy and force me to switch. There is some news suggesting 50% haircut – actually a c2.5x return would be a decent win.

All the above of course doesn’t imply I support the war in any way. I always say this but buying second hand Russian stocks does nothing to support Putin / the war. Nothing I do changes anything in the real world. For what it’s worth, my preferred option would be to stop the war, provide accurate information on what has gone on to all ‘Ukranians’, let refugees back, put in international monitors / observers to ensure a fair vote then have a verifiably free election asking them what country they want to be part of, in the various areas then respect the result. I’m aware they had an independence referendum in 1991 – but they also voted to remain in the USSR in 1991 too….

H2 has, if anything been worse than H1. My coal stocks have done well but I can’t see them going much higher with coal being 5-10x more than the historic trend. I have sold down and am now running the profit. I have struggled with volatility and sold down some things which in retrospect I regret – notably SILJ (Junior Silver Miners) and COPX (Copper Miners). It is partly as I think we could be due a major recession and much silver / copper demand is industrial. Still think that these metals will do well as production is very contstrained but I am better off avoiding equity ETFs in future. I am better off in my usual area of dirt cheap equities – that I can have faith in and hold. Issue is I find it very, very difficult to find resource stocks that I actually want to invest in.

I’m still at my limit in terms of natural resource stocks, maybe the switch from more discretionary / industrial copper / silver to non-discretionary energy will help.

Energy has done quite poorly, despite very low valuations. For example Serica (SQZ) I am c20% down on despite it having over half the market cap in cash and forecast PE under 2/3. Its currently investigating a merger / takeover. I dislike the deal on a first glance but havent yet fully run the numbers and don’t have complete information.

PetroTal – again done poorly, down about 20% due to issues in Peru, forecast PE under 2, c1/3rd of the market cap in cash.

GKP with a c40% yield, PE under 2 and minimal extraction cost – albeit with a severe expropriation risk (in my view) – that I have managed to hedge.

My other oil and gas companies are in a similar vein. I am not sure if it’s woke investors still not investing, or if they are pricing in a severe drop in oil prices. Most of these Co’s are very profitable at $70/oil and profitable down to $50. With China re-opening and Biden refilling the strategic Petroleum reserve at $70 I can’t understand why they are trading where they are. Others I hold such as 883.hk, HBR, KIST, Romgaz are not as cheap but I need to diversify as these smaller oilers have a tendency to suffer from mishaps, rusting tanks, production problems, rapacious governments and there aren’t enough of them around to let them make up the bulk of the portfolio. Currently I am at 35% so a big weight and which broadly hasn’t worked this year over the time period I have owned them. I won’t buy more and plan to limit my size to c5% per company.

We will see if these rerate in 2022. There is a lot to dislike about them. Firstly, that they continue to invest despite being so lowly rated. Why invest growth capex if you are valued at a PE of 2/3 and a substantial proportion of your market cap is cash? Far better to just distribute / maintain production in my view. I find it interesting that Warren Buffett insists on maintaining control of his companies surplus cash flow and exerts tight control on their investment decisions whilst far too many value investors are prepared to give management far too much credit and control.

The downside to these companies investing to grow is they are *generally* rolling the dice with exploration and its an unwise game to play, as there is lots of scope for them to not find oil/gas. Even if they acquire there are plenty of bad deals out there and scope for corruption at worst, or very bad decision making at best. I dont trust or rate any of the managements but the stocks are so cheap I will tolerate them for now / until I find better alternatives. I also believe corruption may be why so many of these type of stocks are keen on capex projects – as it’s easier to steal from a big project than ongoing ops. I have no proof/indication of any specifics for any specific company and its very much supposition on my part…

It’s a little frustrating, when I look back to my start 2022 portfolio I had plenty of oil and gas – though far too much was in IOG which I had a lucky escape from. I looked for more in early 2022 but was looking for the best quality oil and gas cos, which on the metrics I look at all happened to be in Russia. Frustrating to get the sector right but not consider that all my oil and gas exposure was in Russia so, ultimately didn’t work out.

I am not sure how much of this lowly valuation is down to ESG / environmental concerns. I suspect this affects it greatly. On the rare occasions I meet people new to investing, ESG is the first thing they ask about and it is really important to many corporates – as it’s the favour du jour. I believe it to be entirely delusional – the entire system is broken and irredeemably corrupt and I’m prepared to embrace this fact, rather than deny it. We will see if this works over the next few years, I suspect hard times will cure people of the ESG delusion but we shall see… The counter argument is that non-ESG companies can’t raise capital so are not as cheap as they appear. I do not believe this is the case in the longer term – the cynical will once again inherit the earth.

I have tended to get into the habit of buying these stocks on good news, expecting this to trigger rerating, then selling on bad news, which comes along with surprising regularity. Goal for 2023 is to buy as cheap as possible then just hold. Selling the tops looks appealing but once it becomes clear that oil is not going to $50 / ESG doesn’t matter then the rerating could be formidable, even a 5x cash adjusted PE will give JSE / PTAL 100%+ in terms of share price.

In terms of my other resource co’s Tharissa is still very cheap. I have traded a little in and out with a minimal level of success, though like the oil companies they are a stock trading sub-NAV on a tiny multiple and, of course, the conclusion they come to is it’s time to invest in Zimbabwe, rather than a buy back or return cash via dividends. Brilliant guys, brilliant…

Kenmare is also cheap on a forward PE of under 3, one of the world’s largest producers, at the lowest cost and a 10% yield. The issue is that if we are heading to a major recession this may hit demand and pricing. Nevertheless it can easily be argued that this is in the price.

Uranium is still a reasonable weight but its very much a slow burner for me – I am sure it will be vital for generation in the future but when the price will move to incentivise new production remains unknown. I still think KAP is undervalued, though it hasn’t done well over the last year. In breach of my no sector ETFS rule I still own URNM, very volatile but I have cut the weight down to a level I can tolerate. The real money in uranium will be likely made in the technology / building the plants but nothing out there I can buy – Rolls Royce just looks too expensive and there is too much of a history of massive losses occurring during the development of new nuclear technology.

One of my better performers over the year has been DNA2. This consists of Airbus A380s which were trading at a significant discount to NAV, when I bought they were trading at a discount to expected dividend payments. In a similar vein I have bought some AA4 (Amedeo AirFour Plus). If dividends are paid as expected I hope to get about 20-30p a share over the next 5 years, then the question is what are / will the assets be worth? Emirates are refurbishing some of the A380s so I think there is a decent prospect they will be bought / re-leased at the end of their contract or at least have some value. We are in a rising interest rate environment now and the cost of airframes is a major part of an airline’s cost. If they buy new at a c0-x% financing rate then, perhaps fuel / efficiency savings make new planes worthwhile. This calculation changes if they are having to buy new, with a higher capital value at a higher interest rate – making the used aircraft relatively more attractive and economical. There are also delivery issues across Boeing and Airbus, again helping the used market. Offsetting this, air travel is not yet back to 2019 levels and a severe recession / high fuel prices may kill demand further. Still my bet is on the A380s being worth something and the A350s also having a bit of value, with a c16% yield if they hit their target, I get paid to wait, though some of this is capital being returned, though its hard to say how much as we don’t really know how much the assets are worth.

Begbies Traynor is another big weight but has not done much, given it’s now increased weight with the potentially permanent demise of my Russian holdings. I think it’s a useful hedge to the rest of the portfolio. It’s one I need to cut on account of excessive weight.

I’m broadly amazed how strong everything is. UK energy bills have risen to a typical c£4279 in January 2023. UK GDP per capita is roughly c£32’000 -post tax this is 25k so energy is now 17% of net pay. This is a big rise from c £1100 or 4% pre-war. The average person/ household doesn’t pay this directly – as its capped by the government at c£2500, this is, of course, not entirely accurate – the subsidy will be paid by taxpayers eventually. I’m aware I am mixing household and individual figures – but the principle applies lots of money is effectively gone. Various windfall taxes can shift burden around a bit. Don’t forget the median person earns under £32k – due to skew from high earners. If you couple this with rising food prices / mortgage rates and no certainty on how long this will last and I am amazed shares are as resilient as they have been. I suspect this is driven by the hope that this is temporary. I have my doubts as to this.

I have tried a few shorts as hedges – broadly they haven’t worked. My main bet has been to assume the consumer – squeezed by insanely high house prices / rents and mortgage rates, high energy costs and rising tax would cut back. I have shorted SMWH (WH Smiths) and CPG (Compass Group). Unfortunately we are still seeing recovery from COVID in year on year comparisons and there appears to be little fall off in consumer demand. It could be I am in the wrong sectors. SMWH do *mostly* convenience retail at travel locations, CPG outsourced food services. I thought these would be very easy for people to cut back on. For example, bringing a chocolate bar bought at a supermarket for 25-35p rather then buying one at SMWH for £1. This hasnt worked as yet. Its possible people are cutting back on things like clothes rather than convenience items / lunch at the office etc. This actually makes a lot of sense as the saving from not buying that extra jacket equals many chocolate bars… I find it very difficult to anticipate what the average person spends on / will cut back on. I’m sticking with the shorts for now – these companies are valued at PE’s of 19 and 23, in a rising rate environment, I just can’t see them continuing to grow. Nevertheless I am approaching the point at which I will be stopped out. A more positive short is my short on TMO – Time Out – very small, heavily indebted, both an online listings magazine and local cuisine market business, it was not making money even before inflation induced belt tightening. I could do with a few more like this, but many seem to be on PE’s of 10, so whilst I think they only look cheap due to peak earnings it’s not a bet I am willing to make. I haven’t been able to make money shorting the Gamestop’s / AMC’s. I’m not wired to tolerate large drawdown’s on a stock that is going up that I already think it overvalued. Tempted to keep going with small attempts at this to try and learn to be more able to put my finger on the pulse of the crowd and get it near the top. I’m far better at picking the bottom on a stock.

I also shorted NASDAQ (Dec 16th 9900) via puts – didnt work – though was in profit much of the time… In addition, I switched some of my cash from GBP to CHF – pretty much at the low, currently down 5.7%. I’m not tempted to switch back – I have no faith in the UK economy – current account deficit of 5% – before imported energy cost hikes really kick in, coupled with a budget deficit of 7.2% of GDP. The rest of the West isnt much better. This also explains my reasonably healthy weight in gold metal, I cant be sure where the bottom is and want to hold ‘cash’, only I don’t want to hold actual cash as I have no faith my cash wont be devalued so gold or a ‘hard’ currency such as CHF is probably next best thing.

In terms of life this year’s loss has been a major blow. I was planning to quit the world of employment in early 2022, but the situation is such that I have postponed it. If we assume my direct Russian holdings are a 0, I have gone from having c45 year’s spending covered last year to only around 25 years, it doesnt help that I was badly hit by the inflation – my consumption is heavily food / energy based. Not sure what the next steps are – I still work part time, in a pretty straight-forward remote job but am increasingly fed up of the world of employment. I do wonder whether if I were not splitting my time I would have made the Russian error / put quite as much as I did in. I was looking for a substantial quick win. For a lot of years I have thought about moving somewhere cheaper than the UK, probably Eastern Europe. The problem at the moment is this would involve pulling more money from my somewhat diminished portfolio as well as a big change in lifestyle. I am waiting for either the job to finish or my energy co’s to substantially rerate – so I am not leaving so much on the table when I pull out the funds to move country.

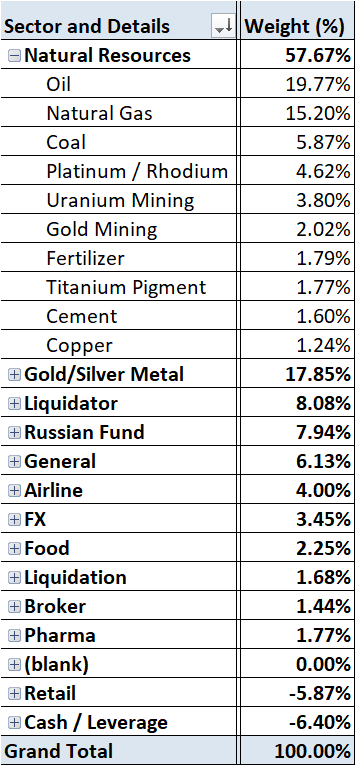

Detailed holdings are below:

There is a little leverage here, but plenty of cash / gold to offset this – so in effect this is a small bet against fiat. I view it as actually being c14.9% cash.

I sold some BXP this year as I was forced to by my broker dropping it from my ISA, I still like it.

I sold DCI, Dolphin Capital – after many years of holding, I think rate rises have changed the relative picture, with this trading at a c 67% discount to a potentially unreliable NAV, whilst I can buy something like BBOX for a 42% discount to NAV but it’s far more legitimate, and has solid cashflow. I don’t own BBOX yet – I will when/if I can pick it up for a much lower cash flow multiple. After rate rises I don’t entirely trust the NAV’s of these co’s / realizability at this NAV. It’s a very different world at higher rates, particularly as rates continue to rise. There is a counter argument as inflation can raise the value of some property / rate rises may be temporary but it’s not a bet I am willing to make at the moment. I am going to be looking for cheap / sold off property but will value it primarily based on FCF / dividend yield.

In terms of sector the split is as follows:

I’m heavily weighted towards natural resources / energy, actually it’s worse that as my Russian stocks and my Romanian fund Fondul Proprietea are both heavily natural resource / energy price linked. There is a powerful counter argument – in that rate rises kill demand and with it the marginal buyer causing high resource prices – so a small decrease in economic activity could cause a large fall in resource co prices. It’s a credible argument and part of why I pulled out from silver/copper miners (mostly) in the summer. My reply is that there is still a lack of investment, many of the stocks I own have large cash piles and high cashflow per share – they mostly pay for themselves in two/ three years. In even a long dip they should do OK and supply shortages may mean they can rise out any recession – in 2008/9 energy and resources performed surprisingly strongly.

I am going to limit any further weight to natural resources – though I might switch between stocks, tempted to cut the more mainstream oil and gas co’s in favour of more exotic holdings if I can find stocks of sufficient quality.

Not in a rush to buy anything – unless it is really cheap or cheap and low risk / quick return. Very little out there really appeals, though I am continually drawn to Royal Mail as a decent business, going through a difficult patch that will likely rerate. I’d like to switch cash / gold into undervalued investment trusts / very cheap businesses with high margin’s and large cash piles, but, as ever, these seem to be hard to find.

As ever, comments appreciated. All the best for 2023!

Commiserations on a poor year’s performance. I was personally down 18.5% for the year after two stellar (+57% and +52%) years following a -17% and a +17% in the previous two. Prior to that I was invested for a long time in mainly a 60%/40% split between a UK all share index tracker and a S&P 500 tracker as I didn’t have the time to be active.

It’s hard to look at things unemotionally when you have such poor results.

The only other investor I take a lot of notice of invests only in UK housebuilders and trades between the ones which he considers best value as their short term SPs fluctuate. His return was circa. -35% for the year. He averaged 20% a year from 2020 prior to this year. So like you a very good track record.

I started the year with 60% invested in a portfolio of uranium developers & explorers, 30% UK housebuilders and 10% other. Ended the year 75% in the uranium portfolio, 15% UK housebuilders and 10% other. No trading between sectors.

I got interested in the uranium sector after you pointed out YCA in 2020. The uranium developers/explorers portfolio has pretty much been coupled to the US stock market performance over the year but is a lot more volatile. Uranium as a commodity has done pretty well relatively speaking (to equities) and for what it’s worth I see that continuing. What the miners/explorers do is anybody’s guess. My guess is that at worst they remain coupled to the US market with a risk to the upside if they decouple. KAP is a different proposition and looks very attractive (IMHO) but I’m not ready to give up on my more speculative position just yet.

I can’t get excited about any UK stocks and like you I find it hard to rationalise how they have performed so well in general. UK housebuilders like BWY trading well below book value so a lot of the negativity in the SP in my opinion but I don’t see them decoupling from the market as a whole in the near term (but who knows?). Back in 2007/8 they did briefly touch a PBV of 0.45 so the potential downside is still there. Most of the time BWY trades at a positive PBV with the long term average (30 years) being 1.3 and has been known to get close to 2. So I’m looking at them as a 5 year investment.

I’m keeping my allocations the same but will constantly review and perhaps move to a less volatile, less risky approach to my investment into the uranium sector.

Good luck for 2023.

Well done John, risky allocation. Not at all tempted by UK house builders – all the prices supported by low financing costs, all at highs vs household income – though it has been for a while.

I’d agree uranium is performing like a 2x levered S&P ETF. I’m content to have a small weight and run it for a long time.

I think the oil and gas co’s I am in are worth a look, they are very profitable, even at $60/$70 oil and on single digit cash adjusted PE’s they are my main hope for 2023.

My year was bad but its still not 100% clear what happens to my Russian holdings. I could get come out on top, regardless it was an unwise move, driven by greed / complacency that I won’t be making again.

Correction….

“He averaged 20% a year from 2020 prior to this year” should have read “He averaged 20% a year from 2000 prior to this year”

Where is that ? Can’t find it in what I wrote…

No, it was my comment that I was correcting.

Notice your portfolio has almost no ‘vice’ stocks from sectors like Alcohol,CannabisGambling,Pornography Tobacco etc.Of course they always have the threat of govt regulation but one does notice how even in a cost of living crisis consumers are finding the money to spend on their vices.As a recreational poker player i can tell you that UK poker rooms are absolutely full .Alcohol seems to have become 2 tier – people over 40 are drinking more and more whilst increasingly people under 40 do not drink .The long term trend is that more and more countries are legalising Cannabis. Notice suprisingly that teenagers are still taking up tobacco whilst people over 30 who have not given up yet struggle to do so.I gave up at 26 – 3 decades ago .Cannot comment on the future growth of pornography as not a consumer myself and do not mix with anyone who would admit to being so.

Yes it doesnt have much. As I don’t drink, don’t smoke and my only gambling is on shares its difficult for me to get into this… These vices are all consumer products and I find it hard to judge when I don’t use, never have and never will. Still if they are cheap enough wouldn’t rule it out.

Stick with Russia its not the time to sell I think.

I just bought some RSX in a private trade, buying at a similar discount to how JEMA trades, I think it it will be ok. but its a small weight in my portfolio.

Atento is a interesting name at these prices.

Up 10% for the year in the company i run and c. 25% in my spv , all liquidations or run-off fund instruments / liquidations